Before you start applying for P2P loans, you need to know some important facts. Banks are regular investors in these loans. P2P lending allows you to choose the bargain conditions in future. The provider of this finance tracks all its participants. A single person can only apply for one loan at a time. If you have not paid off your previous loan, you cannot apply for a new loan. Registering and filling out a special form will give you some points. The higher your score, the more likely you are to get approved for a loan. The rating shows whether you are a responsible borrower, which is important when making financial decisions.

Banks are a regular investor in P2P financing

The study results show that P2P platforms and banks have different priorities. Lenders prioritize lower-risk loans, while platforms prioritize attracting more borrowers. This leads to a conflict of interest as both lenders and borrowers may be attracted to the same high-interest rates. This is also the reason why banks and other institutional investors are not interested in investing through P2P platforms. The government’s efforts to promote competition in the banking industry have been unsuccessful.

When it comes to loan terms, P2P financing is similar to an online dating site. You set up an account, deposit your funds, and choose the type of borrower you want to fund. Then, you choose whether to lend money to high-risk borrowers or low-risk, lower-risk borrowers based on risk profiles. Unlike banks, P2P platforms do not interact with individual borrowers.

It’s a savings-and-investment opportunity

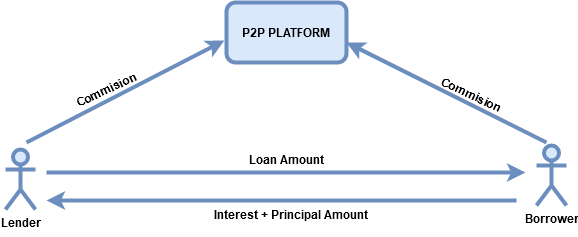

A growing number of platforms have popped up recently offering peer-to-peer lending. These platforms match borrowers and lenders through online software. These platforms are similar to traditional banking, but have some differences, such as varying interest rates and loan terms. Borrowers typically submit loan requests through a website, and lenders wait for repayments from the investors. The risk associated with these investments is minimal, and borrowers can earn higher returns than with traditional banks.

Unlike other forms of savings and investment, P2P lending typically yields higher returns than conventional investments, and is unsecured. P2P financing is based on the cash flow generated by the business and does not require assets or equity in the business. However, the interest rate can be lower than traditional savings accounts. While interest rates on P2P loans are often less than 3%, the potential for higher returns can outweigh the risks of a high-risk investment.

It’s flexible

When you borrow from a peer-to-peer lender, you are not limited to the amount of money you can borrow, but you are more likely to find a lender that is flexible in its terms. Some of these sites require set-up fees and origination fees, which reduces the amount you can borrow. Additionally, late payments and non-sufficient funds fees can hurt your credit and make it difficult to secure financing in the future. If you don’t know much about peer-to-peer lending, you may want to consider a traditional bank or lender before committing to this type of financing.

P2P lending Malaysia platforms assign each borrower to a risk category, which dictates the interest rate. Since the process is fully automated, you can avoid the hassle of submitting a loan application and waiting for approval. You can also enjoy flexible repayment terms and early settlement options. As long as you have a good credit score and debt-to-income ratio, you can use P2P financing to pay for your medical expenses.

It’s a way to earn money from your interest payments

You may be familiar with P2P financing. It is an online platform in which you lend money to other people. When you borrow money from a marketplace, you will split your interest payments with other lenders. Some platforms assign grades to loans, which allows you to make more money on your interest payments. Others allow you to invest in auto loans and track your earnings. You can choose which of these platforms to use for your loan.

If you’re looking for a passive income stream, P2P financing is a great option. Many people use this model to pay off high credit card bills. These loans are usually low-interest loans that can be used for a variety of purposes. Education expenses, medical expenses, or high-value assets are great examples of P2P loans. Small businesses also look to invest in P2P loans to expand or purchase new equipment. As an investor, you can earn money from your interest payments, diversify your portfolio, and make a difference in people’s lives.

It’s a way to make a difference in the lives of people and small businesses

Peer to peer financing Malaysia connects individuals with money to finance their business. P2P loans are arranged between strangers on an online marketplace, bypassing the traditional bank. Because they are relatively quick and easy to arrange, P2P financing is popular with borrowers who would not qualify for a traditional loan. They also provide great financing options for those with less than stellar credit, and those who want to take advantage of low rates.

Unlike traditional lenders, peer-to-peer loans are more affordable than credit card debt. In fact, many loans are approved instantly, with no waiting period and the money typically disbursed within two weeks. Peer-to-peer lending protects investors from losing money on investments, and is especially useful for small businesses that have a poor credit history. The minimal paperwork involved in P2P lending also reduces the chances of a loan being denied.